Who am I? A measly government employee who loves to travel using credit card rewards. Who is Dave Ramsey? A mega-millionaire who has helped millions of people get out of debt, lead a fruitful life, and leave a lasting legacy.

I’m not financially perfect nor am I a millionaire. But I am on the path to become one using 98% of what Dave teaches and preaches on his daily show: investing in Mutual Funds, getting out of debt, paying off the mortgage, etc. In part because of what I’ve learned from him, I’m going to retire with dignity as a millionaire. I’m a HUGE fan!

Where Dave and I diverge in opinion is on credit card usage.

Myth: Credit Cards are good

Myth: Credit Cards are bad

Where’s the truth?

While Dave is insistent that Credit Cards have no place in the world, I have 15 of them.

Dave’s team recently published an article on his website entitled “The Truth About Credit Card Debt.” The opening line: “There is no good reason to have a credit card.” That would make me about 15x Dumb.

Fact: Credit cards are inanimate objects that can be used irresponsibly or responsibly.

Dave himself says it: “Personal finance is 80% behavior.” For those unfamiliar, the other 20% is not “cutting up your credit cards”, it’s “head knowledge”.

But let’s go deeper into this article and discuss. The whole of it can be found HERE.

Supporting Statements

The article begins “responsible use of a credit card really doesn’t exist. Don’t believe us? The Federal Reserve has found that Americans have over $1 trillion in credit card debt.(1) The numbers don’t lie. Credit card debt is a major problem in America.”

Fair enough, Credit Card Debt IS a major problem in America and $1 Trillion is a huge number. The problem is that the writer of the article connects two unrelated statements.

Try this on for size:

Responsible eating in America’s adults over 20 years of age doesn’t really exist. Don’t believe me? The CDC found in a 2013-2014 study that 70.7% of Americans are overweight or obese. (Source) The numbers are there, overweightness and obesity are a huge problem in the country.

Have you never seen a healthy adult in your life?

Sure, the usage of “doesn’t really exist” may just be an exaggeration of “extremely rare”, but Dave’s whole business model is based on turning people into the “extremely rare”.

Speculation Breaks an Argument

The article continues: “Think about it for a second. When you open a credit card account, you’re likely to pay thousands of dollars in interest over the years as you carry a balance. Even if you promise to pay it off every month, all it takes is one lost or missed payment. If that happens, your interest rate skyrockets, you get slapped with fees and it dings your credit. Either way, you’ve gotten yourself into a big money mess.”

It’s tough to gauge the intended audience here, but let’s break this down:

Right off the bat their article speculates that “you’ll” be paying 1,000s of dollars in interest on a carried balance. Now maybe the article is referring to the general population, but the word seems to imply that someone willing to learn about personal finance (I mean, you made it to his website) is powerless to keep their balances paid off.

The #1 RULE of keeping credit cards is to NEVER carry a balance. The article tries to make rules irrelevant by offering more speculation- what happens if a payment gets lost or missed? But you MUST NOT miss a payment. If you are carrying a balance on your credit cards, this is not the website for you!

What happens if a payment gets lost? Well, Dave’s team presents a point that only proves none of them have credit cards. Unless you’re living in the 90’s, payments won’t get lost, because you won’t be making them via mail. Every one of the 15 cards I hold (and all the cards I’ve held in the past) can be paid online. Why would you spend the time (and the money on stamps) manually filling out paperwork when you can complete a simple payment with a few clicks?

Okay, so you get into a car accident and go into a weeklong coma- you miss a payment! The article correctly speculates that your interest rate will go up, you may be subject to a fee, and your credit will get dinged. Where the article deteriorates is when they state “you’ve gotten yourself into a big money mess.”

Reality Check

The reality of missing a payment means that after you come out of your coma you’ll pay off your balance. The fee (usually no more than ~$35), will likely be waived. Worst case scenario is you’re now out $35, and hopefully you won’t go into another coma anytime soon 😉 The increased interest rate should be irrelevant because you are following the #1 Rule, so you won’t be paying interest anyways. The ding on your credit score may prevent you from taking out a new credit card for a few months (maybe a year tops), and may temporarily hinder your ability to finance a car— but we’re supposed to be following the rest of Dave’s plan anyway, so you will only be paying cash for a car, not financing.

It’s all FAR FROM a “big money mess”.

If you Angle it Right (Or Purposefully Wrong)

Let’s continue to the discussion on airline miles. The article presents a scenario where the cardholder pays an $80 annual fee and spends $8000 per year (~$665 a month)on the credit card.

The writer is at least knowledgeable enough to know that it takes thousands of miles to book a flight. But discouraging people from eating apples by presenting a rotten one is deceptive, and the article presents the lowest value situation possible.

In the example given, after spending $24,000 over three years and paying $240 In annual fees, the credit card holder is able to book a $250 ticket for free. Definately not worthwhile.

Let’s review a real-world example: the United Airlines Credit Card. This card has a $95 annual fee. Right now the card offers a sign-up bonus of 40,000 miles if you spend $2000 on the card in the first 3 months. So you pay your phone bill, car insurance, groceries and gas each month and even with the articles’ $665 example you’ve spent $1995 (Maybe pay next month’s phone bill in advance if you need some way to make up the $5 difference).

You can also add a spouse or a family member as an authorized user (doing so doesn’t mean you have to let them have a card or use your account) and you’ll get another 5,000 miles once you make the first purchase with your card.

So now you have 47,000 United Airline miles. Maybe you keep it for another 6 months more and spend another $3,500 on it, taking you to 50,500 miles or more.

Now we have dozens of options for using those miles, and I wouldn’t suggest blowing them on a flight from Tennessee to Nebraska in First Class. But let’s take the article’s example of getting a $250 flight for ~24,000 Miles. In this case you would be getting 2 $250 flights, for a total value of $500, in 8 months, for a single $95 annual fee.

That’s a lot different than spending $240 in annual fees and spending 3 years of your life to get a $250 flight.

Would I recommend keeping this card for another 3 years afterwards? Not necessarily. Easily enough you could transfer the credit line from that card to another Chase credit card (Maybe one with no annual fee) and close the United Card with minimal impact to your credit score.

Of course, there are other benefits like free checked bags and club lounge passes when you pay for your United flights with the credit card, but you have to weigh that value on your own.

My example above is a more typical “apple”, if you will. But our website tends to focus on golden apples. For instance, signing up for three cards (Chase Sapphire Preferred, United Explorer Card, United Business Explorer Card) would cost you the whole of $95 in your first year. After meeting the spend requirements on each card, you would have the opportunity to fly Lufthansa First Class overseas for ~$150, after which you could cancel the cards and not be subject to annual fees.

A single ticket on Lufthansa First Class will normally run $5,000-$10,000 dollars. But you won’t hear about that on Dave’s show/articles!

Cash is king, but not always?

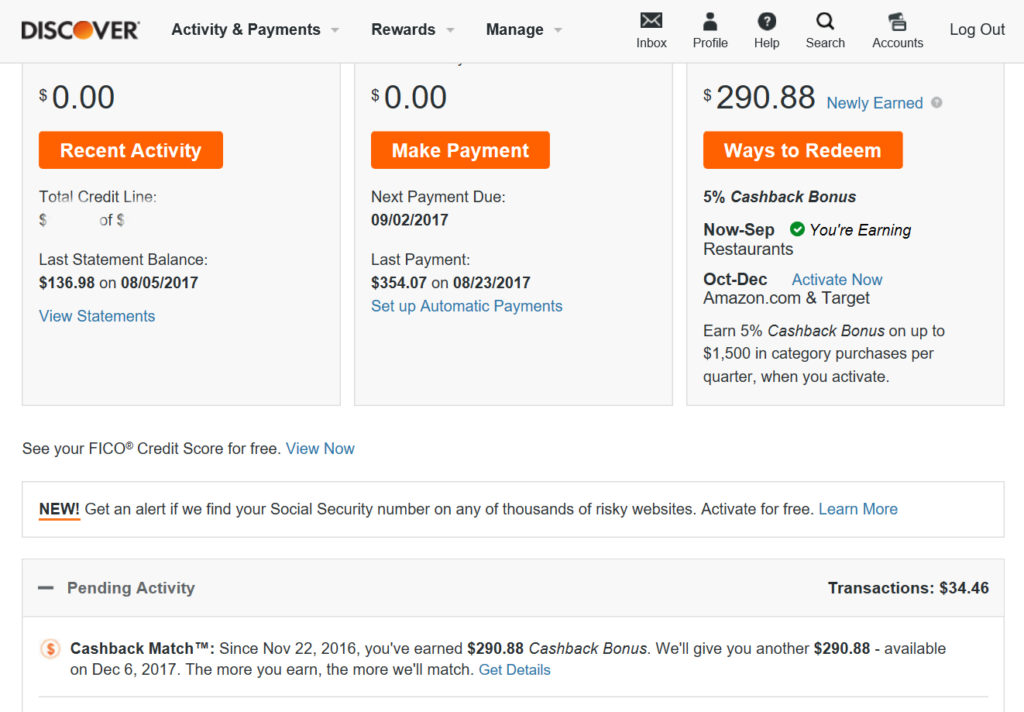

How about a short discussion on Cash Back? While our focus is mostly on travel rewards, I do use a couple of “Cash Back Only” cards: the American Express Blue Cash Preferred, and the Discover IT Card. I likely won’t be using the Discover IT Card after this year, and my other no-fee cashback cards are kept locked away unused.

The American Express card does indeed come with an annual fee of $95 that is waived the first year. Never mind that you get $150 for signing up and spending $1000, let’s quickly review the articles’ postulation that “You have to spend thousands on a credit card to get a measly $100 cash back. Oh, and it’s probably just a credit applied to your account anyway, not actual cash in your pocket. And it might be just enough to cover your annual fee. How about you keep your cash instead?”

This sounds like it’s coming right from the mouth of Dave. It wouldn’t be too surprising. Dave has repeatedly said on air that you would have to spend $100,000 to get only $1,000 cash back.

This is only partially true.

I use the Blue Cash preferred card at the grocery store to earn 6% back on grocery store purchases up to $6,000 in the year, then it leaves my wallet for the rest of the year. I earn $360 cash back from those purchases, minus the $95 annual fee, for a total of $265.

In honesty it does sound pretty measly, which is why it’s only a very small portion of my credit card strategy. But it’s still 4 TIMES as much as Dave discusses, and if you kept the card for a single year and met the sign-up bonus requirement, you’d net $510 from $6000 in grocery store purchases- more than 8 TIMES as much as Dave claims. So again, he and his team are discouraging apples by pointing out the ones in the dumpster.

The No-Annual Fee Discover IT Card offers new members 10% Cashback on some purchases for the first year!

Next, the article touches on “Rewards” (described in the article as coupons and discounts). I personally do not invoke this strategy, so have little to say about it. No, you certainly shouldn’t spend $150 just because you’re getting a 15% discount. Yet, again the article makes an arrogant claim that any savings you receive by a discount (say you get $150 back on $1000 television purchase you would’ve bought anyways) is negated by interest. But you aren’t paying interest, because you’re FOLLOWING THE #1 RULE! So yes, despite the disdain, it REALLY IS saving you money.

Credit Score TRULY is irrelevant:

Further discussion touches on the obsession with credit score and the psychological impact of using Cash VS Credit.

Frankly, as long as you’re following the #1 rule, there’s no need to concern yourself with your credit score, because it will always be very good or excellent. I might recommend a few strategies to avoid unnecessarily harming it, but in honesty I look at my credit score less than I look at my 401K and IRA.

And no, I don’t believe anyone “needs” a credit score, but it certainly can add convenience to life.

As far as spending cash vs. using a credit card, I 100% believe I spend more with my credit card than I would if I used all cash. Do I think I’d be a smarter consumer if I went card-less? No! If I were going to be a smarter consumer I’d make more purchases at the chain grocer 5 miles away, where I’d earn 5 times as many points on my credit card AND pay less for my groceries than I do at my local elite grocer (Think similar to “Whole Foods”). In fact by getting extra points at said chain grocer, I actually find myself more often wanting to go there for my grocery purchases instead of the elite grocer. Of course, this isn’t true in all of my spending, but just one example.

Ironically I paid over $100 in overdraft fees when I used to use a debit card. To this day I’ve still paid no interest or penalties on any of my credit cards.

Ultimately:

Do I really HATE Dave Ramsey? Of course not! While I’m passionate about Credit Card Rewards, I understand why he teaches what he does. I sometimes wish they would pull back from their “absolutes”, because there are those of us out there getting a TON of value from our points and miles. But he makes compelling points most of the time, albeit occasionally misleading.

Nobody is getting rich off of credit card points/rewards/cash back, but then again, that’s not the point of it all! Follow a simple rule and reap plenty of benefits, and follow some simple strategies and you could travel like a king.